Well this could collapse in spectacular fashion or work out well, but whatever happens, you guys get to come along for the ride and watch the results.

For a very long time I've had a Margin Account at a self directed brokerage that I've never done anything with. I've always viewed Margin as a risk I didn't really feel like taking, but as life goes along, I've decided to start playing around with it. And I decided it would be fun to let people watch as I either flame out in a collapse of galactic proportions, or succeed beyond my wildest dreams.

I started at the beginning of the year, so you're already coming along for the ride after it's started. A few bullet points before we start.

- I am not rich, so I'm not putting into this more than I can lose. If you want to see people losing their life savings for a healthy dose of schadenfreude, Wall Street Bets on Reddit is always fun

- Margin is risky. Don't take anything I say or do as investment advice because I am not a professional. This is an entertaining way for me to pass the time and hopefully, maybe, make some money.

- My goal here is to put extra funds into the margin account and use that margin to pay bills and live life, while dividends from the stocks hopefully start to outpace the amount being borrowed. Given these plans, I fully expect the margin amount borrowed to outpace dividends for a good few years, but this is a 5 year plan.

- Let's see what happens...

First off, the Shares. That's what I have in my account, and the value of those shares can be used to borrow cash on margin. Usually it's at a set ratio of anywhere from 30% to 70%. So if you have shares valued at $1000 with 70% margin, you can borrow $700. Interest on the margin loan is generally pretty decent (some of the information has been removed for security reasons)

Now, people use margin accounts for different reasons and may take big risks in them. My goal is to use dividends from the shares to offset the interest I pay and the amount I borrow, so over time you'll see I don't generally buy high risk shares. It will usually be steady, boring companies that pay reliable dividends. I might change my mind. I guess we'll see.

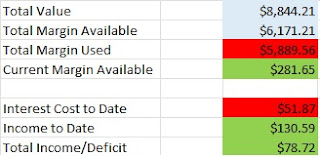

The Total Value is the current market value of all the shares. This is what's used to calculate Total Margin Available which is the total amount I can borrow from the account. The plan is to have at least $2000 a month put into the margin account to buy shares (so far I'm over that but things can change), and use a portion of the margin to pay for life in general, while over time the dividends will hopefully start paying for both the interest and amounts being borrowed.

Comments

Post a Comment