Brookfield Renewable Partners (BEP.UN) review!

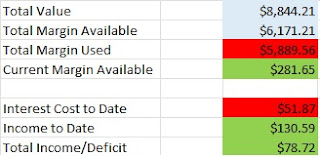

So why is Brookfield Renewable Partners part of my margin account? There are three primary reasons that I wanted to outline. As I mentioned before, one aspect of holding a margin account for the purposes I intend it for requires being able to cover off interest with the yield from the stocks inside it, so unlike other types of stock accounts intended to save for retirement, there are different considerations I have for picking stocks to place inside it.

1: Dividend Yield Part of maintaining my margin account requires dividend stocks be able to cover the interest on margin with a gap. Brookfield Renewable Partners is currently at a yield of about 4.33% (at the time I am writing this), which is a pretty fair return. More importantly, they have a strong history of increasing payouts on an annual basis.

2: Financial Position Brookfield has a solid pipeline of revenue producing projects in a largely regulated industry, which means that while they have a fairly high level of debt, their current revenue stream and revenue growth is protected more than it would be in non regulated industries. In addition, Brookfield Renewable Partners is also under the Brookfield umbrella of companies, and benefits from those ties in terms of access to markets, funding and management expertise.

3: Renewable Focus With the globe shifting towards increased reliance on renewable energies, the current focus Brookfield has on that space, as well as their long term experience in managing and bringing to compleition renewable projects, gives them an advantage over utility companies that are only just now starting that shift.

So that's quick run down of why this is going to be a slow accumulation pick inside my margin account!

Comments

Post a Comment