Power Corp Review (TSE:POW)

So one thing I'll do over time is explain why I hold certain stocks in my margin account (as opposed to say a TFSA or RRSP.

I recently bought Power Corp (TSE:POW) as I felt it is a long term, solid dividend player that's been beaten up along with all the other financials, although it is more of a holding company for financial services than it is a traditional bank. Power Corp has under it Great-West Lifeco (an insurance and wealth management company with several subsidiaries of its own), IGM Financial (wealth management services and mutual funds), Groupe Bruxelles Lambert (a European wealth management holding company), as well as several financial tech companies (including Wealthsimple). This doesn't cover all the ground, but is a good example of how diverse the holdings Power Corp has across the financial spectrum, and why I feel it's taken a significant, but unwarranted hit in the current environment.

They also recently raised their dividend, something they've done for at least the last 18 years, through several financial crisis points, which is a pretty solid history. And with the share price having taken a beating, the current yield is 6.08%. For a solid long term performer, that struck me as a really good entry point.

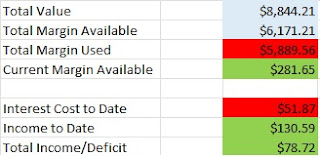

With what I felt was a low entry cost (as of March 31st it was at $34.54, a range it's been stuck in for the last two weeks), that kind of yield on a large, low growth company was too hard to ignore. It gives my account the opportunity to experience not just a solid dividend to pay the expenses and pad the margin, but also capital appreciation.

Comments

Post a Comment