Margin Update!

It's been a good week!

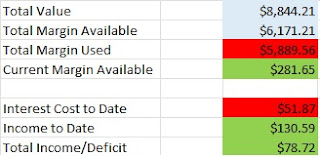

First off the account. It continues to have a total value well ahead of schedule, which is positive, although I've borrowed more against it than planned as well due to some high cost expenses that have come up. But again, that's what the account is for. While it does ultimate increase my interest costs, my current dividend schedule should allow that to be comfortable covered.

I also picked up some shares in Brookfield Renewable. Renewable Energy as an asset class got hit hard last year, as did utilities in general, and while they have recovered somewhat this year, many stocks in that sector are still under what I would consider to be a fair price. The added bonus to me is that Brookfield Renewable pays its dividends in US dollars, so there is a bit of a currency hedge in place when you buy the Canadian units on the TSX (TSE:BEP.UN).

Currently the markets are still in a space where there is anticipation of a recession, and no one really knows how long, how severe, or even if one will happen at all, and consequently a lot of quality companies have share prices at a point where I personally want to load up on them as much as possible. Some companies that usually have dividend yields in the 3%-4% range are currently at 5%-6% due to price drops, and when you factor in the history of dividend increases those companies have, I feel like it's a good way to get ahead of inflation.

Currently the markets are still in a space where there is anticipation of a recession, and no one really knows how long, how severe, or even if one will happen at all, and consequently a lot of quality companies have share prices at a point where I personally want to load up on them as much as possible. Some companies that usually have dividend yields in the 3%-4% range are currently at 5%-6% due to price drops, and when you factor in the history of dividend increases those companies have, I feel like it's a good way to get ahead of inflation.

Comments

Post a Comment